Here are answers to some questions that have recently been raised by regulated entities with regards to OFAC compliance requirements.

Are banks and other regulated entities required to screen account beneficiaries?

YES. As stated by OFAC, “it is prudent for financial institutions to screen account beneficiaries upon account opening, while updating account information, when performing periodic screening and, most definitely, upon disbursing funds.”

In other words, your KYC onboarding and ongoing screening, along with AML screening of transactions’ beneficiaries must always be performed.

Is Sanctions Screening required for Instant Payments?

YES. OFAC demands banks to “ensure their sanctions compliance controls and related technology solutions remain commensurate with the sanctions risks presented by instant payment systems.”

OFAC requires instant payment providers to adhere to all relevant sanction screening regulations, clarifying that the AML rules for instant payments are no different than those for other transaction types.

It highlights the requirement for a risk-based approach, making it clear that the financial institution’s management commitment is one of the most important essential components of compliance. In other words, the institution’s management is directly responsible for any pitfalls in the adherence to the respective regulations.

Is Sanctions Screening required for ACH?

YES. According to OFAC, ACH transactions require sanctions screening as any other payment or transaction.

FFIEC emphasizes the demand for screening ACH transactions, referring to the expanded overview section, “Automated Clearing House Transactions,” page 216 and pointing out that “OFAC has clarified its interpretation of the application of OFAC’s rules for domestic and cross-border ACH transactions and provided more detailed guidance on international ACH transactions.”

FFIEC also specifies that Due diligence for inbound or outbound ACH transactions “may include screening the parties to a transaction, as well as reviewing the details of the payment field information for an indication of a sanctions violation, investigating the resulting hits, if any, and ultimately blocking or rejecting the transaction, as appropriate.”

Historically, sanction lists contained names transliterated into Latin characters. Recently the common practice took a turn, and currently most sanction lists provide both transliterated names and names written in their original scripts.

These are just a few examples.

There’s a growing trend in global regulations toward enhancing AML compliance accuracy, and the regulating authorities are increasingly emphasizing the importance of using precise original name representations for more functional AML compliance. While this approach offers significant potential for precise name matching, the limitations of current technologies make it a challenging goal to achieve.

Why is it important to screen names in original scripts?

There are no universally accepted rules for transliteration.

Therefore, no transliterated name can be 100% reliable for AML screening.

The regulators send a clear signal that the current request for screening names in their original scripts is becoming a Global requirement.

This is to ensure that transliteration variations do not obscure the picture and that no romanization is required in the process.

What to avoid when choosing your next Sanctions Screening technological solution?

Avoid systems uncapable of screening names directly in their original languages, relying on romanization transliteration technologies to convert names into Latin characters. Such lead to False Negatives (“Missed Hits”), or on the flip side, in order not to miss, you are forced to cast a wide net that generates multiple probabilities, which will end up in multiple False Positives. Romanization ends up with a wrong name.

What to look for?

Sanction screening solutions must be capable of directly screening the names, individual or entities, in their original languages “as is,” not using a third language (Latin script) as an intermediary.

At the very least, such system needs to be capable of screening names in Cyrillic script (Russian, Ukrainian, etc.), Chinese, Korean, and Arabic.

As conflicts and terrorism persist, more individuals and companies face sanctions, highlighting the critical need for strict compliance with regulations to prevent funds from reaching sanctioned parties. Regulatory bodies have tightened not only the rules but also the oversight of compliance, leaving no room for mistakes.

The world-leading service & community F6S ranks Fincom #1 among Israel’s Top 78 Government/Fintech Startups 2024

Fincom is proud to be recognized by F6S – the service & community helping millions of founders and their companies grow. F6S chose Fincom as the leading Israeli startup of 2024, ranking #1 among the 78 top Israeli companies with the most profound impact in the Fintech industry. It is a true honor that such a leading worldwide organization as F6S made us part of this list.

F6S’ recognition comes after 2023 Fincom’s AML Sanctions Screening Suite was commercially deployed in 11 US banks, including Tier 1 and Federal banks. All are reporting a considerable reduction in operational burden along with unparalleled efficiency and effectiveness.

Live in 11 US Banks, Fincom excels in delivering tangible results for Banks & Fis, thus climbing a wave of considerable growth acceleration. Fincom received clear market acceptance due to the results it delivered. Today, Fincom is actively seeking to support dozens of prospective customers in its pipeline.

Recently, Fincom has also been recognized by a number of prestigious awards, among them: Banking Tech Awards, RegTech 100, RegTech Insights, and Sibos 2023. The exciting announcement by F6S with its community of millions of startups and entrepreneurs worldwide, is an important confirmation of Fincom’s breakthrough year!

2023 is coming to an end, and Fincom is summing up the results, while looking forward to the new year with hope and anticipation.

During 2023 Fincom was blessed with incredible new clients and partnerships. Fincom has also enhanced its existing solutions with new features, started new developments, entered new markets…

For the last few years Fincom has collaborated with Finastra, one of the leading global payment providers. Fincom’s AML Sanctions Screening system is now integrated into all Finastra’s payment solutions. Finastra has become Fincom’s number One worldwide reseller.

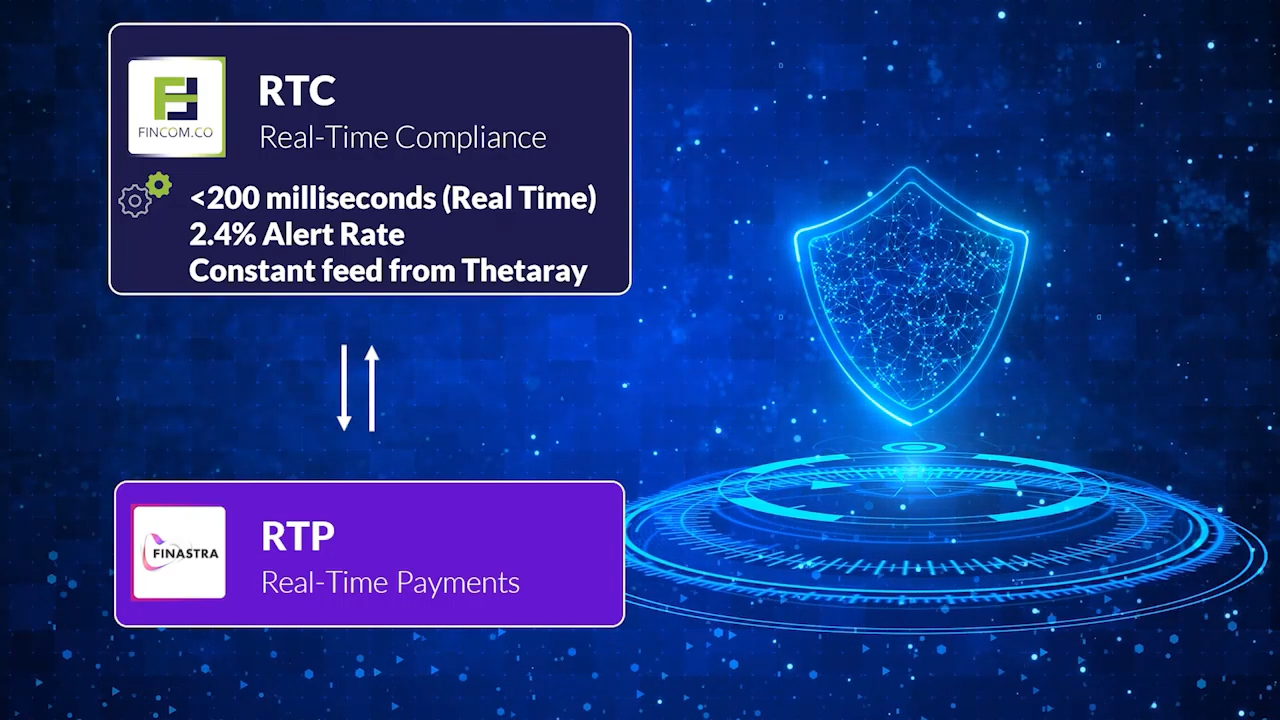

In 2023 Finastra and Fincom have announced the launch of their RTC for RTP service.

By merging their distinct capabilities, Finastra and Fincom have birthed a unified solution that surpasses individual potential. This partnership isn’t just about RTP or RTC, but a holistic platform that presents a strong shield for banking operations. This community-first approach has set a foundation, paving the way for other partners to join and collectively elevate the standards of banking operations.

Metrics that Matter:

Read more:

Fincom & Finastra: Real-Time Compliance meets Real-Time Payments

***

In 2023 Fincom was recognized for its innovative approach and advanced solutions that help banks and financial institutions considerably reduce their operational costs and workloads while increasing the quality of services and covering all AML sanction screening requirements.

Fincom’s Real-Time AML Sanctions Screening recognized by the Banking Tech Awards USA 2023

Fincom’s winning solution revolutionizes AML Sanction & PEP screening, addressing critical challenges faced by financial institutions. With its Phonetic-Linguistic Engine based on Phonetic Fingerprint technology, Fincom’s Real Time AML Sanctions Screening provides unparalleled screening accuracy and operational efficiency. The system eliminates unnecessary burden on compliance teams, mitigates workloads, and decreases operational costs by >90%! Moreover, Fincom’s solution is designed to prevent AML discrimination, thus upholding fairness and integrity within the compliance framework.

2023 – Perfect Pitch: Fincom – the Community Pioneer

We at Fincom are proud to have been recognized for our innovative contributions. Our co-founders, Gideon Drori and Dr. Oleg Golobrodsky were active participants in the discussions that took place at the conference. Even more excitingly, Fincom emerged as the winner of this year’s Sibos’ Perfect Pitch competition. Gideon Drori had the honor of delivering the winning pitch that encapsulated Fincom’s vision for and practical steps towards a collaborative financial industry as a Community Pioneer.

Fincom with its leading AML Screening Solution is recognized among the world’s most innovative RegTech companies.

Being included in RegTech 100 list for the second time, shows company’s dedication to innovation and continues excellence in bringing efficient solutions to the financial industry. The RegTech100 list serves as a valuable resource for senior management and compliance professionals seeking to evaluate solutions with market potential and a lasting impact on the industry. Fincom continues to be at the forefront of this industry, delivering exceptional value to its clients worldwide.

Watch Fincom’s latest 2023 short videos and interviews

Sibos TV: Meet the ‘Discover the perfect pitch winners’

Sibos 2023: Navigating Compliance-as-a Service Solutions

Fincom: Community Pioneer

Fincom: Ambitious Adventurer

Stepping into 2024

More and more financial and non-financial institutions are benefiting from advanced unique capabilities provided by Fincom’s AML solutions. Many US banks have already incorporated Fincom’s system and report exceptional quality, sharp reduction in operational burden, ease of use…

Fincom starts delivering its AML solutions to the Insurance industry. Insurance entities present a substantial opportunity for the facilitation of money laundering activities due to their involvement in the extensive transfer and management of substantial financial resources. Fincom helps Insurance firms implement transparent and accurate AML screening practices, maintain reputation, and gain consumer trust.

Fincom also focuses on the issues of Bank Account Verification and Confirmation of Payee. According to leading international cross-border payment providers, approximately 5% of all payments are misdirected, landing in wrong accounts. Banks incur significant losses due to operational costs involved in handling misdirected payments. According to regulatory requirements, payment service providers (PSPs) must verify whether the account number and the name of the payee provided by the payer, match. If not, the payer should be notified immediately after they enter their counterparty Account Number and name in the PSP’s app or website, before being able to finalize the payment.

Fincom delivers ultimate solutions for Bank Account Verification for both Incoming and Outgoing payments, resolving mistakes and fraud attempts that lead to Misdirected payments.

At the heart of the solutions is Fincom’s unique technological capability of accurate name matching, based on its Phonetic Fingerprint Technology (see details below).

Fincom with its leading AML Screening Solution is recognized among the world’s most innovative RegTech companies.

Being included in RegTech 100 list for the second time, shows company’s dedication to innovation and continues excellence in bringing efficient solutions to the financial industry.

Fincom is a fast-growing company offering the best AML Screening Solution to date, proven in US banks to reduce operational costs and false positive rate by >90%. US banks that have already adopted Fincom’s solution benefit from considerably reduced workloads, incredibly low alert rates, and smooth payments processing.

The RegTech100 recognizes the 100 most innovative companies globally, playing a pivotal role in shaping the future of compliance, risk management, information security, and financial crime prevention.

Gideon Drori, Fincom’s co-founder and CEO, said, commenting on the company’s inclusion in the RegTech100 list for the second time: “Being recognized among the world’s most innovative RegTech companies for the second time is a testament to our dedication to providing the best-in-class AML solutions. We are proud to contribute to the evolution of regulatory technology, offering our clients unmatched capabilities in sanctions screening and regulatory compliance.”

The RegTech100 list serves as a valuable resource for senior management and compliance professionals seeking to evaluate solutions with market potential and a lasting impact on the industry. Fincom continues to be at the forefront of this industry, delivering exceptional value to its clients worldwide.

Painless AML compliance for any payment. Today we are presenting the future: The most accurate AML OFAC screening technology on the market.

Fincom at Sibos 2023: Leading the Real-Time Compliance for RTP Community

The financial world is witnessing an unprecedented collaboration – a partnership that emerges as a potent amalgamation of Finastra’s acclaimed Real-Time Payment (RTP) platform and Fincom’s innovative Real-Time Compliance (RTC) system, driven by its AML Sanction Screening and Real-Time Compliance Boost-API.

What sets this alliance apart? It’s a symbiotic relationship wherein each entity contributes its niche expertise. The companies aim at crafting a community solution that outperforms individual efforts. Finastra’s insight into the necessity of RTC has paved the way for adopting Fincom’s outstanding OFAC screening solution, already employed across multiple US banks. This not only optimizes compliance but also significantly trims down associated costs.

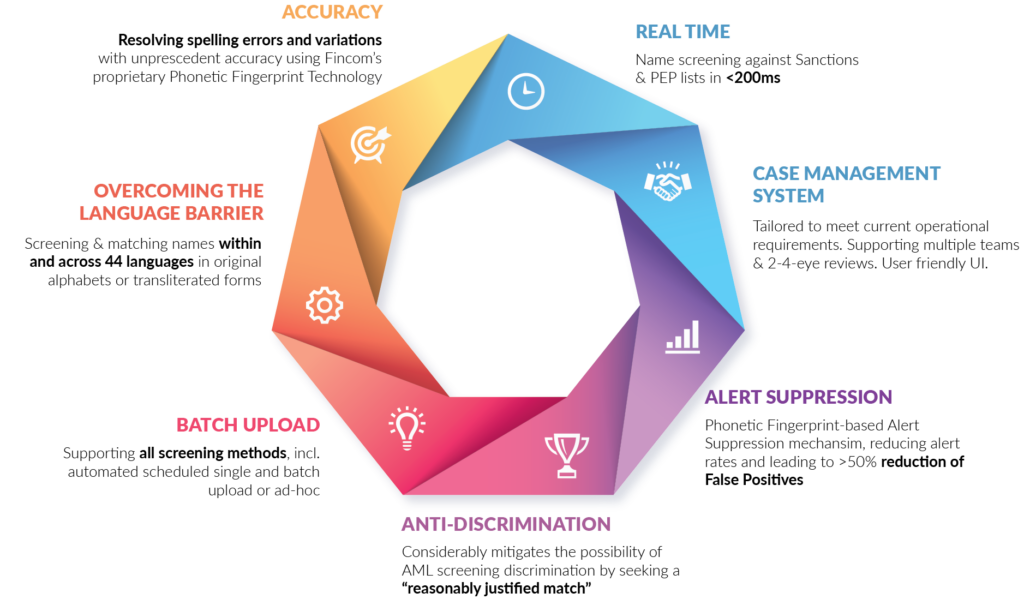

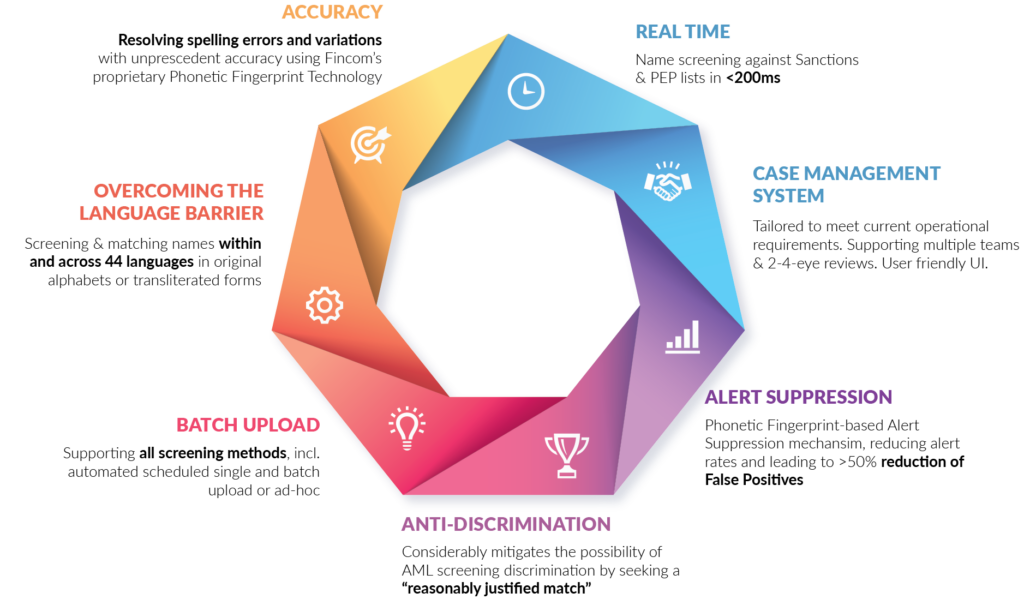

Fincom’s Real-Time AML sanction screening system is genuinely groundbreaking. The patented Phonetic Fingerprint technology powers instantaneous transactions (under 200 milliseconds) with unmatched precision. This efficiency translates to a stark reduction in alert rates, manual resolution time, and, hence, operational costs.

Further enhancing this is the Boost-API, which invites other AML technologies into the fold. For instance, Thetaray’s inclusion into the community amplifies the RTP-RTC suite with its advanced AML Monitoring and AI Investigation capabilities. Thetaray enriches the Finastra-Fincom offering by updating it with Transactions monitoring, ensuring top-notch AML Monitoring compliance. And, Fincom’s Consolidate Case Management System acts as the backbone, providing a centralized hub for managing multiple RTP-RTC solutions.

This alliance transcends standard partnerships. Merging distinctive capabilities, Finastra and Fincom offer an efficient RTP bolstered by a secure RTC. In a marketplace shifting from individual products to comprehensive solutions, the trinity of Finastra, Fincom, and Thetaray formulates a triangular shield, positioning itself as the linchpin for banking operations. By sidelining competition, these entities are not only collaborating but inviting other organizations to join the cause.

Key Elements that Define This Alliance:

The tangible benefits are evident in banks where the system has been rolled out. This all-encompassing, cloud-based platform can integrate seamlessly with other banking infrastructures, simplifying real-time payments, transaction monitoring, fraud combat, and AML compliance. A hands-on demo further bolsters this belief, allowing clients to witness the platform’s capabilities in real-time.

Metrics that Matter:

This collaboration between Finastra, Fincom, and Thetaray underlines the transformative potential of partnerships. By integrating unique solutions and pioneering innovations, they’re shaping the future of real-time payments and compliance.

The finance world converged in Toronto for Sibos 2023, a conference that has been the linchpin for discussions, debates, and decisions affecting global finance. The theme this year, ‘Collaborative Finance in a Fragmented World,’ couldn’t have been more timely. With a financial landscape mired in uncertainty—be it economic, geopolitical, or technological—Sibos provided a platform for challenging old paradigms and imagining new ones.

Today financial institutions and Fintechs find themselves at a crossroads. On the one hand, we face unprecedented challenges – economic instability, geopolitical tensions, ever-evolving financial crime landscape. On the other, technological advancements present enormous opportunities for growth and innovation. The consensus at Sibos? Neither can be effectively tackled in isolation. Collaboration and community are not just buzzwords but an imperative.

During the conference a plethora of financial thought leaders shared insights on pressing matters that demand collective attention. Topics like ESG standardization, cross-border payments, AML compliance, and many others were debated.

We at Fincom are proud to have been recognized for our innovative contributions. Our co-founders, Gideon Drori and Dr. Oleg Golobrodsky were active participants in the dialogues that took place at the conference. Even more excitingly, Fincom emerged as the winner of this year’s Sibos’ Perfect Pitch competition. Gideon Drori had the honor of delivering the winning pitch that encapsulated Fincom’s vision for and practical steps towards a collaborative financial industry as a Community Pioneer.

The financial world is at a crucial juncture, and the discussions at Sibos have set the stage for collaborative efforts that will shape the future. So let’s take the learnings from Toronto and turn them into actionable insights, because the path forward is together.

Real-Time Compliance (RTC) meets Real-Time Payments (RTP)

In an era where financial transactions move at the speed of light, ensuring these payments are compliant, secure, and efficient is paramount. Enter the trailblazing collaboration between Finastra and Fincom.

Finastra and Fincom established a close collaboration to deliver a unified solution: Finastra’s leading Real-Time Payment (RTP) together with Real-Time Compliance (RTC) system led by Fincom AML Sanction Screening and its Real-Time Compliance Boost-API.

This breakthrough methodology sets the foundation for each vendor to contribute their specialized expertise by connecting to the Boost-API to deliver AML compliance for RTP, forming a unified community solution that surpasses what anyone could achieve individually, and geared to grow and improve with ever changing demands. Finastra delivers a fully developed advanced RTP platform with the foresight that RTC is required, thus adopting Fincom’s superior OFAC screening solution which Finastra has already implemented in numerous US banks optimizing compliance and significantly reducing associated costs.

Fincom’s Real-Time AML sanction screening system allows conducting instantaneous (<200 milliseconds) secure transactions screening with unprecedent accuracy. Empowered by patented Phonetic Fingerprint technology, it excels in precise efficient screening, considerably reducing alert rates, manual resolution time, and operational expenses.

Its full Real-time AML sanction screening solution for KYC onboarding and pKYC (ongoing monitoring), real-time sanction screening for all payment rails powered by proprietary Phonetic-Linguistic engine, contributing to the reduction of alert rates from >30% to <3% and ensuring no Missed Hits.

Finastra provides its RTP platform, proven to be the best solution for real-time payments processing worldwide, along with deep industry penetration and established superior reputation as the leading payment platforms provider.

By merging their distinct capabilities, Finastra and Fincom have birthed a unified solution that surpasses individual potential. This partnership isn’t just about RTP or RTC, but a holistic platform that presents a strong shield for banking operations. This community-first approach has set a foundation, paving the way for other partners to join and collectively elevate the standards of banking operations.

This is not just a technological breakthrough. It’s a philosophy of unity. By setting competition aside and focusing on collaborative growth, these companies have positioned themselves as “community pioneers”. Fincom-Finastra RTP-RTC solution, deeply integrated and open for partnerships, marks a transformative change in the banking sector.

Customers don’t just have to take our word for it. The efficacy of this collaboration is evident in institutions where it’s already in play. With a significant reduction in operational expenses (over 90%), a drastic cut in alert rates (from the industry average of 30-50% to less than 3%), and a shortened manual alert resolution time (from an average of 8 minutes to just 30 seconds), the advantages are clear.

For those still on the fence, a hands-on demonstration showcases the platform’s real-time payments processing and its unparalleled AML screening capabilities. Witnessing this in action provides undeniable proof of the system’s benefits.

In the end, it’s the vision, mission, product, and service that win trust. Fincom and Finastra, with their shared goals and unwavering dedication, have crafted a solution that not only meets the challenges of today but is geared for the demands of tomorrow.

For financial institutions seeking an all-encompassing, efficient, and secure RTP-RTC solution, the Fincom and Finastra collaboration presents an offer that’s hard to refuse.

Lessons from OFAC Enforcement Actions of the first half of 2023

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has been significantly active in 2023. Beginning in March, there have been nine enforcement actions, resulting in penalties surpassing the mark of $556 million. Delving into the details of these sanctions, some key learnings surface that could shape corporate compliance measures in the future.

In an intriguing case, a renowned U.S.-based Bank encountered a $97.8 million penalty. The issue? Inadequate oversight over a European Bank’s compliance risks, which inadvertently led to apparent U.S. sanctions violations against Iran, Syria, and Sudan. This serves as a potent reminder of the importance of oversight in ensuring sanctions compliance, even in smaller and non-core business lines.

A leading U.S.-based software maker found itself settling a hefty $3.3 million for apparent violations of sanctions and export control laws. The root cause was a lack of complete or accurate customer information. The software maker, through its Irish and Russian subsidiaries, inadvertently provided prohibited software and services to sanctioned jurisdictions and individuals. This underscores the significance of gathering extensive customer information to spot potential red flags.

Highlighting personal liability, an executive from a U.S.-based skincare company was faced with a $175,000 fine over alleged sanctions violations concerning Iran. The crucial takeaway is clear – company management may find themselves directly accountable for sanctions violations, emphasizing the gravity of each decision made.

In a unique case, a foreign bank settled for $3.4 million due to apparent violations of OFAC sanctions concerning Crimea. The bank’s customer, using an IP address from Crimea, sent payments through U.S. correspondent banks. This enforcement action serves as a reminder of the importance of geofencing and IP screening as pivotal compliance tools.

Financial institutions should treat customer assurances with caution. Relying on unsubstantiated information can lead to compliance breaches, as seen in the foreign bank’s case linked to Crimea. Instead of accepting customer claims at face value, a thorough investigation into potential red flags should be the norm.

The enforcement actions from the first half of 2023 emphasize the evolving nature of compliance and the paramount importance of proactive and thorough measures. Whether it’s extensive screening, regular audits, or ensuring personal accountability, a holistic approach to sanctions compliance is the need of the hour.

Lessons from OFAC Enforcement Actions of the first half of 2023

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has been significantly active in 2023. Beginning in March, there have been nine enforcement actions, resulting in penalties surpassing the mark of $556 million. Delving into the details of these sanctions, some key learnings surface that could shape corporate compliance measures in the future.

In an intriguing case, a renowned U.S.-based Bank encountered a $97.8 million penalty. The issue? Inadequate oversight over a European Bank’s compliance risks, which inadvertently led to apparent U.S. sanctions violations against Iran, Syria, and Sudan. This serves as a potent reminder of the importance of oversight in ensuring sanctions compliance, even in smaller and non-core business lines.

A leading U.S.-based software maker found itself settling a hefty $3.3 million for apparent violations of sanctions and export control laws. The root cause was a lack of complete or accurate customer information. The software maker, through its Irish and Russian subsidiaries, inadvertently provided prohibited software and services to sanctioned jurisdictions and individuals. This underscores the significance of gathering extensive customer information to spot potential red flags.

Highlighting personal liability, an executive from a U.S.-based skincare company was faced with a $175,000 fine over alleged sanctions violations concerning Iran. The crucial takeaway is clear – company management may find themselves directly accountable for sanctions violations, emphasizing the gravity of each decision made.

In a unique case, a foreign bank settled for $3.4 million due to apparent violations of OFAC sanctions concerning Crimea. The bank’s customer, using an IP address from Crimea, sent payments through U.S. correspondent banks. This enforcement action serves as a reminder of the importance of geofencing and IP screening as pivotal compliance tools.

Financial institutions should treat customer assurances with caution. Relying on unsubstantiated information can lead to compliance breaches, as seen in the foreign bank’s case linked to Crimea. Instead of accepting customer claims at face value, a thorough investigation into potential red flags should be the norm.

The enforcement actions from the first half of 2023 emphasize the evolving nature of compliance and the paramount importance of proactive and thorough measures. Whether it’s extensive screening, regular audits, or ensuring personal accountability, a holistic approach to sanctions compliance is the need of the hour.

Perpetual KYC has recently become a “hot” subject in compliance management. Although all the leading AML solutions providers offer educational information and insights, there is no, to the best of our knowledge, viable solution for Perpetual KYC as of now; the one that fully meets the idea and requirements of the task.

Perpetual KYC, also known as pKYC or Continuous KYC, is a proactive ongoing process that replaces periodic reviews. It continuously screens relevant sanctions and watchlists, promptly triggering alerts in response to changes in the lists, if any. This enables swift incorporation of changes and updates into the KYC process, ensuring efficient and effective ongoing monitoring.

Perpetual KYC is fast becoming a sought-after aspect of compliance management, despite the lack of comprehensive solutions currently available in the market. It encapsulates a proactive process that continuously screens relevant sanctions and watchlists, thereby promptly triggering alerts for any changes or updates. This strategy ensures swift integration of changes into the KYC process, delivering effective ongoing monitoring.

Financial (and non-Financial) institutions lack efficient tools to carry out the ongoing pKYC screening. According to PwC, “there is currently no single vendor that provides all the required capabilities.” Besides, the technologies currently in use:

Being unable to rely on existing technological solutions or to enlarge its workforce (due to already high operational costs), the organizations are forced to screen their customer base periodically, usually once a month/quarter/year, which inevitably results in omissions and potential fines.

Regulators mandate that each financial institution must screen their client database for changes and updates regularly. Fincom’s Perpetual KYC solution provides a fully automated compliance process, screening the client database against the latest sanction or PEP lists without disrupting workflow.

In the challenging landscape of Anti-Money Laundering (AML) compliance, banks, Financial Institutions (FIs), and other regulated entities face the intricate task of customer roster screening. This process often results in a significant number of alerts that require manual resolution, consequently creating substantial backlogs and overwhelming workloads.

FIs, in their quest to mitigate these challenges, have adopted a practice known as “whitelisting”. This involves clearing a name or entity as “verified,” after which it is exempted from future screening processes, including those against updated data.

Though whitelisting may seem like an efficient solution, it carries with it considerable risk. Entities cleared today could end up on sanction lists tomorrow, due to new information that identifies them as sanctioned persons. This can lead to substantial penalties, as exemplified by the case of ING Bank. After whitelisting several individuals who were later revealed to be sanctioned ISIS terrorists, the bank faced a staggering fine of 750 million Euros.

To counter this issue, Fincom has developed a smart Alert Suppression (or Persistence) mechanism. This tool eliminates the need for risky whitelisting and drastically reduces alert rates.

This smart automation for past approvals management ensures constant monitoring of historical vs. current data and reduces the overall false alerts rate to <1% (over time).

With technology advancing rapidly, banks and financial institutions are increasingly adopting AI and ML-based solutions for handling various aspects of AML compliance, including sanction screening, fraud detection, transaction monitoring, KYC onboarding, perpetual KYC, and other processes mandated by regulations. At first glance, AI-based solutions appear to be the most efficient and logical choice for AML compliance in banks and other regulated entities. They offer a swift and seemingly reliable automated process with minimal human involvement. However, a closer examination of the true essence of AI and the potential consequences of integrating these emerging tools into the financial and regulatory landscape exposes some worrisome traits.

Today I’ll concentrate on just one of the problematic issues associated with introducing AI into AML compliance processes.

AI technology, being inherently intelligent, processes new incoming data using a combination of algorithms embedded in the system by developers and new rules developed by the system’s own “intelligence.” As a result, the system operates under rules that users do not manage or regulate, transforming it into an opaque “black box” with internal logic and decision-making processes that lack transparency and traceability. Consequently, compliance personnel or any other system’s users struggle to explain why the system makes certain decisions, flags specific individuals or entities, or clears others.

It becomes increasingly difficult, if not impossible, to trace the source of a decision. As a result, the regulators’ requirement for transparency and explainability is unmet. The system makes decisions and provides answers, yet no human soul can confidently explain the reasons behind these decisions or answers.

Furthermore, regulators need to assess the performance and accuracy of technological aids (systems) used for AML compliance processes, such as screening and monitoring. This evaluation, known as model validation, necessitates, among other things, understanding and explaining the logic behind each decision related to flagging or clearing individuals or entities. The goal is to ensure the following: no threats are overlooked (no false negatives), no individuals or legal entities are unjustifiably affected by the system’s defects and flaws (no unexplained false positives), and the system is free from bias and complies with anti-discrimination laws.

One of the ways to minimize the ‘black-box’ impact is by setting an extremely low fuzzy logic threshold. This would cause the system to alert individuals or entities even in cases of the slightest doubt. However, this approach will inevitably lead to an excessive number of alerts (mostly false alerts), which would then require manual resolution, ultimately increasing the workload and leading to potential mistakes (human factor). As a result, the advantages of using such a sophisticated AI model would become pointless. Besides, this solution does not eliminate the ‘black-box’ phenomenon, but just makes questionable cases explainable by the process of manual resolution.

Another solution is to implement an additional AI model that would verify and validate the decisions made by the original AI screening tool, offering dedicated explanations for each decision (such systems start emerging on the market). However, this approach may seem somewhat impractical — validating one AI model with another AI model. Apart from the evident absurdity, one must consider that such a solution leads to significantly higher expenses. In addition to the AML compliance system(s) – sanctions screening, transactions monitoring, onboarding, ongoing, etc., the regulated entity would need to incorporate an additional AI validation system, along with the necessary compliance department personnel to handle alerted cases.

Using models and algorithms based on mathematics can offer a viable solution that goes beyond relying solely on AI. Mathematical models are more interpretable and provide a clear explanation of how they arrived at a particular decision. This interpretability allows human analysts to understand why a transaction was flagged or cleared, enabling them to validate and explain the screening outcomes and making it easier to audit and justify decisions, if necessary.

Fincom’s system is built on mathematical, phonetic, and linguistic algorithms, creating a clear audit trail. Each decision path is traceable and explainable.

The system provides consistent results, minimizing the risk of unexpected fluctuations or false positives/negatives that can accompany changes in AI/ML training data or internal system-initiated algorithmic changes.

Fincom’s solution offers a clear explanation of how it arrives at specific decisions. This allows human analysts, auditors, and regulators to understand why a transaction was or was not flagged, enabling them to explain and validate the screening outcomes, when required. I.e., the accountability for decision-making lies with explicitly defined processes rather than complex, black-boxed AI algorithms, making it possible to justify and defend decisions, if necessary.

In a recent move by the Federal Reserve, Deutsche Bank found itself in hot water, facing a hefty $186 million fine for its failure to address AML issues. The penalty came as a result of the bank’s inability to make sufficient progress in rectifying compliance lapses that were initially flagged back in 2015 and 2017.

The Federal Reserve conducted a series of examinations and investigations, revealing that the German lender had not adequately addressed flaws in crucial areas of its compliance program. These weaknesses were found in customer due diligence, transaction monitoring, and suspicious activity reporting processes, as well as other aspects of their AML efforts, as stated in the July 13 order.

As a result of the order issued by the Federal Reserve, Deutsche Bank now faces the imperative task of prioritizing the completion of remedial work on its transaction monitoring systems, especially in relation to high-risk business lines. Additionally, significant improvements are demanded in the bank’s customer due diligence processes.

In a separate written agreement, the Federal Reserve also directed Deutsche Bank to enhance its governance processes, risk controls, and data management procedures.

Deutsche Bank has been grappling with regulatory challenges in both Europe and the United States for years now. The issues flagged by the Federal Reserve were first identified in 2015 and 2017 consent orders, highlighting the longstanding nature of the bank’s shortcomings.

Deutsche Bank responded to the fine by expressing its commitment to addressing the identified shortcomings in the near future.

It’s worth noting that President Joe Biden’s administration has taken a stern stance against repeat corporate offenders and the flow of illicit funds through the U.S. financial system, making it crucial for financial institutions to prioritize AML compliance.

For Deutsche Bank, the challenges are far from over, as they have faced various regulatory struggles in the past. In 2021, Deutsche Bank reached a settlement where it agreed to pay $125 million to avoid prosecution in response to allegations of precious metals market manipulation and foreign bribery schemes. Furthermore, the bank settled another lawsuit related, this time, to the facilitation of sex trafficking, and paid $75 million to resolve the issue.

The Federal Reserve’s latest findings expose that a considerable portion of the $276 billion in transactions that Deutsche Bank cleared for Danske Bank (Estonia) included high-risk non-resident customers. Shockingly, the AML shortcomings persisted even after the bank terminated its relationship with Danske Bank in 2015.

This hefty fine serves as a stern reminder to financial institutions worldwide to strengthen their AML compliance programs and address any shortcomings promptly. With stricter regulations and increased scrutiny from regulators, banks must remain vigilant in their efforts to combat money laundering and other financial crimes. The spotlight on AML compliance is brighter than ever, and failure to meet regulatory expectations could lead to severe consequences for banks and financial institutions.

The essential regulatory obligation of anti-money laundering (AML) sanction screening involves the meticulous task of comparing names, addresses, and other details in financial transactions against various watchlists, including government sanction lists. It is a tedious undertaking that regulators insist on performing multiple times every day year-round. Whether it’s processing payments, granting loans, or updating sanction lists, AML sanction screening is mandatory.

The primary reason for excessive operational costs and the tedious structure of sanction screening lies in the outdated nature of existing technologies. These technologies, even the new ones, are not designed to meet the current regulatory and operational demands, particularly the need to screen against huge and diverse multilingual databases of individuals and entities. Consequently, matching names accurately becomes a major challenge.

Currently, the market primarily focuses on three parameters: alerts, false positives, and false negatives.

Alerts indicate a probable hit. Existing technologies yield an average alert rate of 30-50%, contributing to an overwhelming number of alerts.

False positives represent the multiple results obtained per alert. For instance, when using systems considered “advanced” in today’s AML technology landscape, there are approximately nine false positives generated for every single alert. This results in a prolonged alert closure time, averaging over eight minutes. And time is money!

False negatives denote the missed hits, signifying names that should have triggered enhanced due diligence but did not. While this implies that a criminal may have evaded detection, it also indicates that a name requiring scrutiny did not receive the necessary attention.

It is essential to introduce a fourth parameter: the total cost of ownership (TCO). The TCO encompasses the variable costs associated with alerts, false positives, and false negatives, which need to be calculated collectively. This includes expenses related to IT licenses and operational activities required to resolve alerted cases.

It is vital to consider potential costs such as fines due to missed hits, reputational damage, customer retention issues arising from extended processing times, and frequent false alerts.

When a bank is selecting a sanction screening technology, the TCO should be a key consideration. It accurately reflects the true burden imposed by this regulatory requirement. Even if a company pays a higher price for the IT license, a reduced operational burden leads to a far more favorable TCO, saving over 90% in operational costs.

Fincom has developed and deployed a cutting-edge Real-Time AML Sanctions Screening solution that offers the most efficient and effective screening capabilities to banks and other regulated institutions.

Along with ensuring smooth real-time screening with no misses and the lowest on the market alert rate (<3% as opposed to over 30% current market average), Fincom’s solution helps reducing operational expenses by over 90%!

AI models, especially complex ones like deep learning neural networks, lack transparency and interpretability. It becomes challenging to understand why the AI system flagged a particular transaction as suspicious or missed a money laundering case. This lack of explainability hinders effective auditing, accountability, and regulatory compliance.

In today’s regulatory regime, the regulated institutions are required to provide a clear audit trail for all their AML screening decisions, which becomes impossible when an AI system is deployed.

Fincom’s platform provides solutions for each and every challenge of the AML Sanction Screening

Fincom’s AML Sanctions Screening has been proven to reduce alert rates to below 3%. With its highly effective alert suppression mechanism, the system reduces it even further (below 1% over time). This leads to >90% reduction of operational costs!

At the core of Fincom’s Real-Time AML Sanctions Screening lies its innovative phonetic-linguistic engine. it allows tracking phonemes across 44 languages, as well as transliterated names, considering spelling mistakes and variations. This ensures accurate name matching, free of “AI bias” and applicable to both simple and structured names.

By recognizing both the names in their language of origin and their transliterations, Fincom’s technology overcomes language barriers and matches names directly without the need in romanization”.

Accurate name screening in <200 milliseconds

Fincom saves human and technological resources and increases compliance by providing a fully automated perpetual know your customer (KYC) solution that does not disrupt the usual workflow.

Straightforward and transparent audit trail for internal and external audit

Intuitive case management system with an integrated permission hierarchy to facilitate operations across multiple teams with both two-eye and four-eye reviews

In the realm of AML and compliance technology, Fincom’s Real-Time AML Sanctions Screening stands out as a powerful solution that addresses the challenges faced by financial institutions. With its advanced phonetic-linguistic engine, multi-lingual capabilities, real-time screening, and minimised alert rates, Fincom empowers banks to strengthen their AML compliance efforts while minimising operational costs. By leveraging Fincom’s technology, financial institutions can enhance and ensure regulatory compliance in an increasingly complex financial landscape.

The essential regulatory obligation of AML sanction screening involves the meticulous task of comparing names, addresses, and other details in financial transactions against various watchlists, including government sanction lists. It is a tedious undertaking that regulators insist on performing multiple times every day year-round. Whether it’s processing all kinds of payments, granting loans, or updating sanction lists, AML sanction screening is mandatory.

The primary reason for excessive operational costs and the tedious structure of sanction screening lies in the outdated nature of existing technologies. These technologies, even the new ones, are not designed to meet the current regulatory and operational demands, particularly the need to screen against huge and diverse multilingual databases of individuals and entities. Consequently, matching names accurately becomes a major challenge.

Currently, the market primarily focuses on three parameters: Alerts, False Positives, and False Negatives.

Alerts indicate a probable hit. Existing technologies yield an average alert rate of 30-50%, contributing to an overwhelming number of alerts.

False Positives represent the multiple results obtained per alert. For instance, when using systems considered “advanced” in today’s AML technology landscape, there are approximately 9 false positives generated for every single alert. This results in a prolonged alert closure time, averaging over 8 minutes. And time is money!

False Negatives denote the missed hits, signifying names that should have triggered enhanced due diligence but did not. While this implies that a criminal may have evaded detection, it also indicates that a name requiring scrutiny did not receive the necessary attention.

When talking about the AML Screening system, it is also vital to consider potential costs such as fines due to missed hits, reputational damage, customer retention issues arising from extended processing times, and others. However, more importantly, is the issue of an overwhelming number of false alerts that eventually lead to extensive workload, extended working hours, overstaffed compliance departments, inevitable mistakes (due to human factor), and prolonged processing times. All these skyrocket operational expenses.

Considering all of the above, it is essential to introduce a fourth parameter: the Total Cost of Ownership (TCO). The TCO encompasses the variable costs associated with Alerts, False Positives, and False Negatives, which need to be calculated collectively. This includes expenses related to IT licenses and operational activities and resources required to resolve alerted cases.

When a bank is selecting a sanction screening technology, the TCO should be a key consideration. It accurately reflects the true burden imposed by this regulatory requirement. Even if a company pays a higher price for the IT license, a mitigated operational burden leads to a far more favorable TCO.

Fincom has developed and deployed a cutting-edge solution for Real-Time AML Sanctions Screening that offers the most efficient and effective screening capabilities to banks and other regulated institutions.

Along with ensuring smooth real-time screening with no misses and the lowest on the market alert rate (<3% as opposed to over 30% current market average), Fincom’s solution helps reduce operational expenses by over 90%!

Finastra and Fincom have established a close collaboration with strong synergy between the companies to deliver the leading Real-Time Payment solution with an integrated AML Suite.

Finastra has partnered with Fincom to accommodate the growing market need for a reliable AML solution. All Finastra’s payment platforms are now enhanced with this efficient, cost-effective, and extremely accurate AML screening system. This partnership creates a powerful fintech ecosystem that provides banks, financial and non-financial institutions, and other regulated bodies with an entirely secure AML-proof payment system that ensures frictionless payments processing throughout all payment rails (SWIFT, Wire, RTP, ACH, etc.) along with adherence to AML regulations through effective sanction screening for clients onboarding (KYC/KYB), ongoing monitoring (perpetual KYC/KYB), transactions screening, and more.

In the realm of AML and compliance technology, Fincom’s Real-Time AML Sanctions Screening stands out as a powerful solution that addresses the challenges faced by financial institutions. With its advanced Phonetic-Linguistic engine, multi-lingual capabilities, real-time screening, and minimized alert rates, Fincom empowers banks to strengthen their AML compliance efforts while minimizing operational costs. By leveraging Fincom’s technology, financial institutions can enhance and ensure regulatory compliance in an increasingly complex financial landscape.