MODERNIZING BANKING

TECHNOLOGIES

& Entity Resolution

Critical parameters of an AML Sanction Screening System

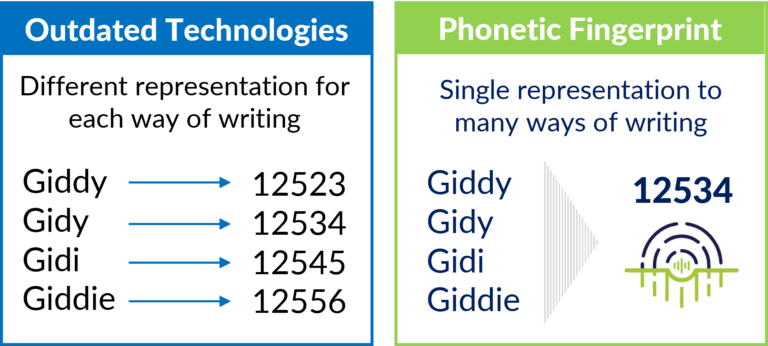

The primary reason for excessive operational costs and the tedious structure of sanction screening lies in the outdated nature of existing technologies. These technologies, even the new ones, are not designed to meet the current regulatory and operational demands, particularly the need to screen against huge and diverse multilingual databases of individuals and entities. Consequently, matching names accurately becomes a major challenge.

Ensure AML compliance

and improve customer experience

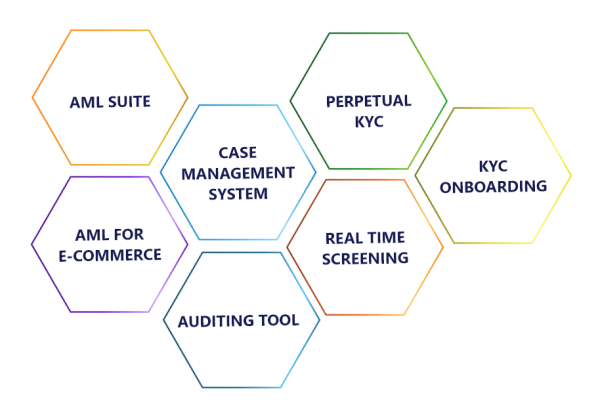

Helping Financial and non-Financial institutions meet regulation requirements for Onboarding, Perpetual KYC, Sanctions screening, and more with the most advanced and accurate persistence automations, Real Time sanctions screening, COP/BAV, Alert Suppression, and more.

Reduce Operational Costs

by 90%

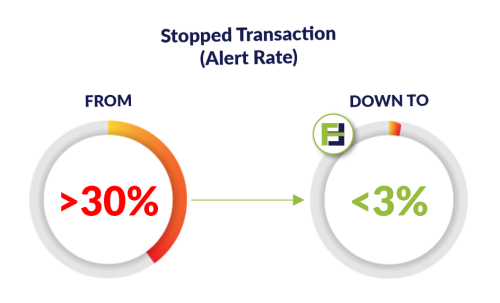

and cut alert rates from >30% to <3%

Known industry alert rate average is between 30 to 50% due to legacy tech. and inability to screen and match names derived from different languages. This results in huge operational burden. Commercial implementation of Fincom’s AML Sanctions Screening demonstrates reduction of operational costs by over 90%! Fincom’s Phonetic-Linguistic engine based on the company’s Phonetic Fingerprint technology successfully resolves cross-language matching challenges.

Trusted by US Banks

Outstanding results

proven in Banks & FinTechs

“Fincom did testing and implementation in an accurate and efficient way! I am very pleased with Fincom and would recommend it to any financial institution.”

Connie D. Rettig, The National Bank of Indianapolis

The Technology Behind

Phonetic Fingerprint technology

Fincom’s Phonetic-Linguistic Engine based on Phonetic Fingerprint technology has an exceptional ability to measure the true level of Phonetic Proximity, dramatically reducing alert rate and false positives.

Phonetic Fingerprint is a single mathematical representation of the pronunciation and phonemes of a name (individual or entity). Tracing phonemes across over 44 different languages in original scripts, across various transliterations and spelling variations, enables accurate name matching.

About Fincom

Fincom offers the best AML Screening Solution to date, proven in US banks to reduce Wire/SWIFT screening operational cost and False Positive Alert rate by 90%. The solution is enriched by an intuitive case management system supporting all the banking verticals such as Fed-Now, RTP, ACH, perpetual KYC, and more importantly increasing the compliance regime of the financial institution.

Fincom’s AML solution is based on core technology for Entity Resolution. Enabling to process multilingual databases for accurate searching, matching and mapping of all the databases irrelevant of format or technology. Fincom’s patented phonetic fingerprint technology enables matching names even when misspelled, in different formats (unstructured), multiple languages/alphabets (44 – including Arabic, Russian, EU languages, Chinese, Korean, etc.) and with transliteration mistakes. The proprietary core technology uses 48 algorithms from computational linguistics, advanced mathematics, and phonetics, achieving unprecedented levels of data management and understanding. The technological breakthrough enables best of class AML Name Screening, Entity Resolution, Database mapping, and information management.

Fincom’s solution is adopted by tier 1 banks in the USA, FI in EU/UK, international regulators, and leading technology companies such as EY, Cognizant and Finastra as a worldwide reseller.