REVOLUTIONIAZING

AML SANCTIONS SCREENING

Ensuring AML Compliance & reducing operational costs by >90%

Cutting down Total Cost of Ownership

(TCO) by >90%

Reducing operational expenses

Fincom’s Sanctions Screening system allows to considerably reduce alert rates, simplify the decisioning process, provide all the required information on the same screen, and process this minimal number of alerts in under 30 seconds per alert. All these contribute to considerably cutting down operational costs.

Proven to cut down operational costs by

over 90%

in major US Banks and global Financial Institutions!

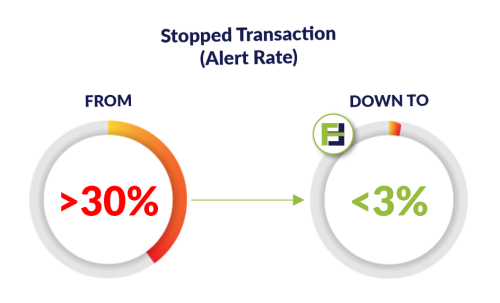

Reducing Alert rates

from >30% down to <3%

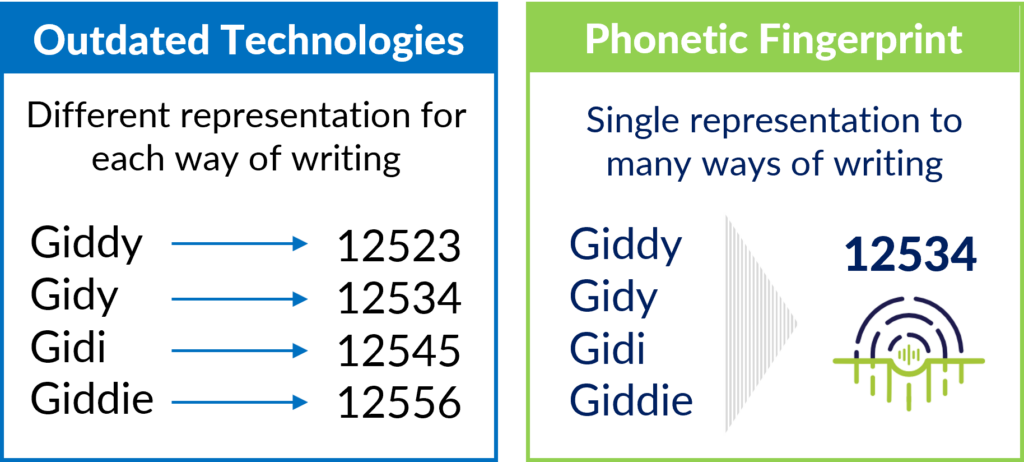

Work overload is a direct consequence of high alert rates. Current sanction screening systems produce between 30 up to 50% alerts, most of which are false. Fincom’s Phonetic-Linguistic engine in combination with other proprietary algorithms considerably reduces the alert rate, overcoming the challenges of transliteration variations, spelling mistakes, and multilingual entries.

Matching names in 44 languages, resolving spelling mistakes and variations

Fincom – the only technological platform accurately screening names from 44 different languages, including original scripts, transliterated forms, complex names, and names’ variations

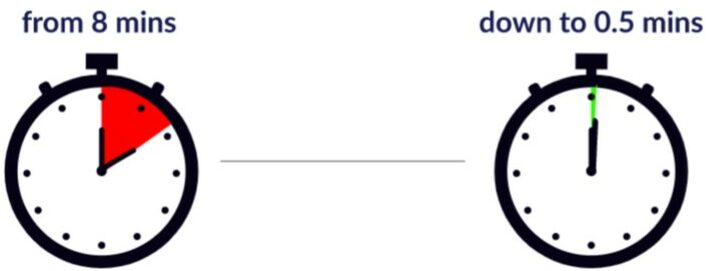

Reducing alert processing

time

from 8 to 0.5 mins

Due to unfriendly and functionally incomplete interface of the systems currently in use, alert processing time averages at 8 mins per alert. Fincom’s Case Management System with its hierarchy structure and availability of all the relevant information on the same screen, provides ideal intuitive UI for fast decisioning and alert processing.

Fully transparent,

explainable & traceable

One of the downsides of the existing sanction screening systems, especially those based on AI, is the lack of capability to support and explain the decisions. Fincom’s system is fully transparent, explainable and traceable, providing a clear audit trail for the whole decisioning process.

one centralized friendly Case Management System

Supports multiple teams’ operations with a built-in permissions hierarchy.

The system supports, among other things: task assignments and allocation, alert management, notifications, dashboard, reports, and more.

All the important information on each case (alert sources, related resources, and other info) is easily accessible from within the system.

WIRE

56 scan fields, including free text

Smart scan: field-specific optimized screening logic

SWIFT

Accurate screening and matching names from 44 different languages directly, eliminating the need in romanization

Accurately matching entries even if names are misspelled or transliterated differently

RTP

Ensuring smooth immediate

(<200 ms) processing of large volumes of payments

>97% of payments are resolved automatically in real time

Reducing manual alert resolution time from ~8 mins to 30 seconds.

ACH

Reducing Alert Rate to ~1%! Allowing to release massive ACH payments much faster and more efficiently.

Unprecedent accuracy is achieved due to smart alert suppression mechanism, especially effective in screening ACH payments.

Fincom offers a robust AML screening solution that utilizes advanced technology for accurate name matching. The solution incorporates a powerful Phonetic-Linguistic engine

with a phonetic fingerprint core-technology, enabling real-time verification of data across multiple sources and 44 different languages in original alphabets. It successfully resolves different name transliterations, pronunciations, and spelling mistakes and variations.

Fincom is specifically designed to provide a high level of effectiveness and precision. The mathematical decision-making mechanism is transparent, traceable, and explainable, aligning with regulatory and operational requirements.