Fincom’s innovative core technology resolves successfully and effectively the key challenges in AML Sanction & PEP screening.

Fincom’s AML SUITE is a Real-Time Sanctions Screening system, designed to provide effective and efficient screening in under 200ms across 40+ languages in the original Alphabets, as well as accurately screening transliterated names, considering spelling mistakes and variations, including unstructured names.

Fincom’s Phonetic Fingerprint core-tech provides maximum assurance against Missed Hits and reduction of False Positives, while also preventing AML-Discrimination.

The AML SUITE includes Real-Time Transactions Screening, Real-Time Onboarding/KYC Sanctions & PEP Screening, Ongoing Sanctions Monitoring, Entity Resolution module with a unique advanced Location/Address and Corporate name resolution; the user-friendly Case Management system combined with Automated Alert Disposition for instant resolution of alerts and reduction of False Positives. REST API allows for fast and straightforward integration with any 3rd party application and data source, PEP or other proprietary list, using Fincom’s Data (Lists) Management Module.

Fincom’s AML Transaction Screening performs high-precision screening in under 200ms (milliseconds) supporting Real-Time payments for banking, eCommerce, and other applications. Suitable for SWIFT and non-banking transactions alike.

The screening is performed as part of the transactions flow and can be integrated with any existing payment system, providing an end-to-end compliance solution for Real-Time multilingual (40+ languages) transactions screening.

The data screened in a transaction is business-case dependent and configurable according to customer’s requirements, transaction type, data contained in Sanctions lists and other data sources, and methods and data available in the payment system.

Fincom’s Case Management System allows AML Compliance Team to effectively manage and resolve Alert Cases, including intuitive UI & color-coded dashboards, comprehensive reporting system, and historical logs for periodic auditing.

The System allows assigning tasks to multiple teams in different locations, 2-eye/4-eye inspection, management, follow-up, and escalations in processing of each Alert Case, including notifications on Flagged individuals or companies and their transition to special ‘Account Restrictions’ Lists.

Based on unique development of its Model Validation Methodology, Fincom has issued an automated tool performing system proofing and/or auditing.

The validation process is performed, by choosing a “Representative Sample” batch file selected randomly from Fincom’s synthetic data repository, containing over 15,000 entries. Such random sample includes all types of cases according to customer’s preferences, settings and system configuration.

System Validation includes a wide range of optional tests covering different use-cases.

Fincom’s advanced technology enables finding Adverse Media from within unprecedented scope while being able to identify the relevant entities, sentiments, and associated information throughout media collected from hundreds of outlets across 40+ languages. The System uses advanced technology, including ML/AI, for aggregation and clustering of Media Articles with enhanced Entity information, correctly identifying Adverse and Negative content within an article and performing sentiment analysis by using advanced mathematics & NLP.

The Assurance microservice adds another safety layer to the existing screening solutions. It is designed to guarantee that NO Missed-Hits can occur. This is achieved by enhancing an existing solution with an ability to identify names in 42 different languages in their original alphabets, as well as accurately screening transliterated names, considering spelling variations and mistakes.

The ability to read the whole name – first, middle, last (an all other combinations) reassures no-misses while at the same time prevent unnecessary and operational burden (overload of manual resolution) or undesired AML-Discrimination.

Exceptionally strong in identifying foreign names, including Russian, Chinese, Arabic, Korean, and others.

The Anti-Discrimination Module (ADM) is a simple and affordable bolt-on microservice, added to existing name screening solutions.

Utilizing Fincom’s patented Phonetic Fingerprint with accurate name matching and exceptional capabilities to resolve out-of-order names, it acts as a suppression engine for alerts rendered by current AML screening solutions. The Module guarantees sufficient phonetic proximity or, in other words, it establishes “reasonable phonetic justification” for an Alert.

The Alert Suppression successfully resolves False Positives, ensuring that names pass through only in case of an Accurate Name Match for the entire name. It means that the engine can produce sufficient phonetic proximity as justification for Alerts. The system utilizes the Phonetic Fingerprint tech. alongside examination of other parameters: address, birthdate, etc.

Smart Alert Suppression also incorporates different methods to distinguish between an Individual or other Entity and to activate different algorithm methodology accordingly, using several types of control thresholds for risk-appetite adaptation.

The Ongoing Sanctions Monitoring is performed automatically at nighttime on a daily basis or as configured, screening the entire FI’s client database against the latest version of updated Sanctions lists or against other required/internal lists.

The regulators Mandatory Requirements state that each Financial Institution must screen their client database to verify against any changes and updates. Besides, each Financial Institute might have its own periodically updated additional internal lists.

ENTITY RESOLUTION:

PRECISION RATE: 97.8% RECALL RATE: 99.2%

Real Time screening in under 200 milliseconds

Screening names in 40+ different languages in the original Alphabets, as well as transliterated names and names with spelling mistakes and variations.

Cross-lingual engine with intra- and cross-language algorithms that enable mapping, identifying, and matching names across 40+ languages.

Simple and fast deployment with customers’ existing solutions via REST API

No Missed Hits – full elimination of False Negatives

Filters both False Positives and non-justified discriminating alerts.

Automated processing & reporting, reducing workload and ensuring accurate results.

“Understanding” the sound of each phoneme, overcoming misspellings, spelling irregularities and variations, transliterations, and different name structures.

Contributing to massive Alert Suppression and reduction of the rate of False Positives in Real Time.

Screening Names of individuals and companies “as is” in the original Alphabets, resolving transliterated and misspelled names.

Real Time screening in under 200 milliseconds. Ensures AML compliance with unprecedent accuracy and precision.

The Trade off between Penalties vs. Poor Customer Service & Legal Claims. The Consequences are: damage to reputation, profit, share value and costs. The Ideal Solution should include Reliable Identification, with no missed-hits, and no false positive.

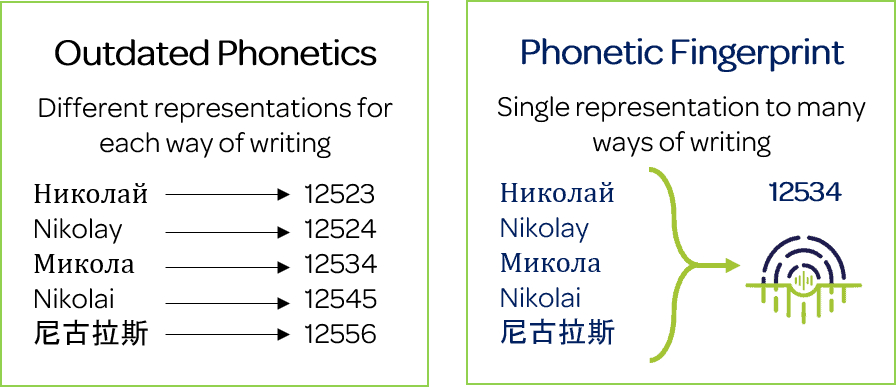

PHONETIC FINGERPRINT is a mathematical representation of a Name – individual, company or other.

Using automated Real Time technology, supported by AI-ML layers, along with 48 mathematical algorithms, the engine TRACES PHONEMES and ENSURES ACCURATE NAME MATCHING across:

Using name’s “Phonetic Fingerprint” (a mathematical representation of a name based on pronunciation and phonemes), the technology allows tracking phonemes across 40+ languages, as well as transliterated names, considering spelling mistakes and variations. This ensures Accurate Name Matching, free of “AI bias” and applicable to both simple and structured names.

Resolving Operational Burden by considerably reducing the number of False Alerts and minimizing False Positives.

Automated processing and reporting and Automated Alert Disposition speed up the process and eliminate human errors.

A dedicated Case Management System allows for delegating and managing alerts within and across multiple teams.

Recognizing and screening Names directly in their original Alphabets in 40+ languages as well as transliterated names, spelling mistakes and variations.