STREAMLINING ONBOARDING

&

PERPETUAL KYC

Fincom’s advanced AML KYC/KYB Screening System addresses key KYC screening challenges while ensuring full AML compliance while reducing . Offering Onboarding KYC/KYB, Perpetual KYC (pKYC), and Periodic KYC solutions, it facilitates accurate screening of customer names, be they individuals or entities, against updated sanction, PEP, and/or internal restriction lists. The screening process incorporates additional parameters (e.g., address, location, phone number, etc.) cross-verification, enhancing overall compliance reliability.

Onboarding KYC/KYB

Sanctions & PEP Screening

- Screening names, individual or entities, against sanction, PEP, internal, or other required watchlists.

- Validating name match using additional parameters (address, DOB, country of incorporation, etc.)

- Name match verification for various compliance processes, e.g. Adverse Media, supplementary forms submission, etc.

Perpetual KYC (pKYC)

Perpetual KYC, also known as pKYC or Continuous KYC, is a proactive ongoing process that replaces periodic reviews.

Fincom’s system is the industry leading fully automated, transparent, and explainable pKYC solution that ensures compliance to regulatory requirements for ongoing sanctions monitoring

Fincom saves human and technological resources and increases compliance by providing a fully automated Perpetual KYC solution. The ongoing process is performed automatically, screening the entire client’s database against the latest version of sanction or PEP lists without disrupting the usual workflow.

pKYC is performed automatically on a daily basis or as configured, screening the entire client database against the latest version of updated sanction and other relevant lists

High screening speed allows for automated screening of the entire database of large clients within very short time and with no human involvement

Screening process may also be initiated, when the system is triggered by a batch file upload. The system allows screening an unlimited number of large “mega” files

Why Fincom's KYC

Saving valuable time and resources Cutting down operational expenses Ensuring regulatory compliance

Reduce operational costs by >90%

Proven to reduce operational expenses by over 90% in major US banks and Financial Institutions, turning compliance from a cost center into a strategic advantage.

Reduce alert rate from >30% to <3%

Fincom’s solution is proven to reduce alert rates from the industry average of 30-50% to below 3% and then to <1% (over time) with Smart Alert Suppression.

Ensure Real-Time sanction screening

Screening time is <200 milliseconds, streamlining the customer onboarding process, ensuring a quick and hassle-free experience and improving customer retention.

Multi-language screening

Screening customers names across 44 languages in the original alphabets, matching them directly to the corresponding entries in sanctions and watchlists, eliminating the need for intermediate romanization.

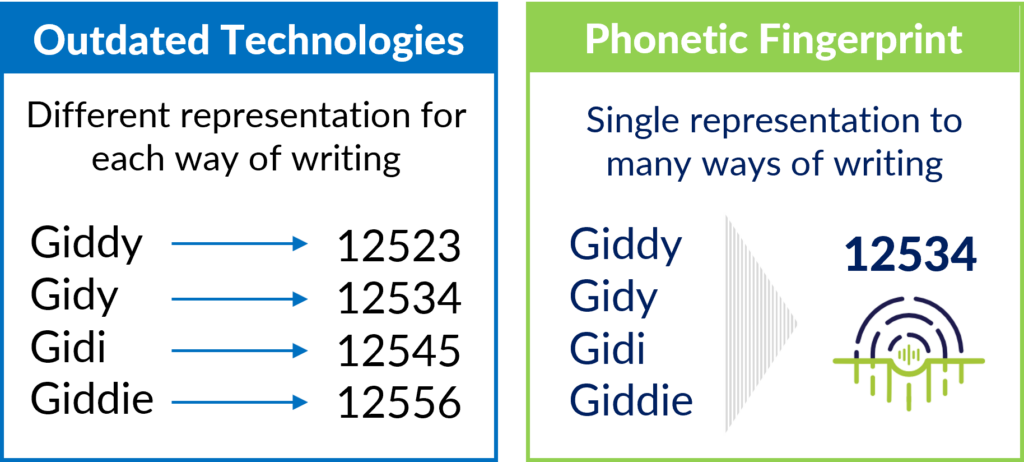

Accurate transliterations matching

Even when dealing with transliterated names, the system accurately resolves spelling mistakes and variations, ensuring that nothing slips through the cracks.

Case Management System

Intuitive graphic Case Management System for fast and frictionless alert cases resolution. For more information on the Case Management System click here.

Transparent, Traceable, Explainable

Ensure full AML compliance with clear audit trail.The system is fully transparent, case resolution results are traceable and explainable.

Fincom offers a robust AML screening solution that utilizes advanced technology for accurate name matching.

The solution incorporates a powerful Phonetic-Linguistic engine with a phonetic fingerprint core-technology, enabling real-time verification of data across multiple sources and 44 different languages in original alphabets. It successfully resolves different name transliterations, pronunciations, and spelling mistakes and variations.

Fincom is specifically designed to provide a high level of effectiveness and precision. The mathematical decision-making mechanism is transparent, traceable, and explainable, aligning with regulatory and operational requirements.