COMPLIANCE MADE EASY

AML SUITE FOR BANKS & FI's

costs by >90% in US Banks and global Financial Institutions

"Our [former] vendor required lengthy updates several times weekly and a very high false positive rating. We were incredibly impressed with [Fincom's] behavioral analytics, ease of use and the customer service of its team. ...I am very pleased with Fincom and would recommend it to any financial institution as a more effective way to scan wires for OFAC violations with very few false positives."

Connie D. Rettig, The National Bank of Indianapolis

Accurate sanction screening

across

all Payment Rails

Wire | SWIFT | RTP | ACH | LC

Accommodates specific requirements of each payment method.

Managed from one centralized Case Management System.

Onboarding KYC/KYB

Sanction & PEP screening

- Screening names (individual or legal entity) against sanction, internal, PEP, or any other required lists.

- Name match validation through additional parameters: address, DOB, nationality, country of incorporation, etc.

- Global address resolution, and more.

Perpetual KYC/KYB

Fully automated pKYC solution. The ongoing monitoring is performed automatically, screening the entire client’s database against the latest version of sanction or PEP lists without disrupting the usual workflow

Intuitive graphic

Case Management System

Supports multiple teams’ operations with a built-in permissions hierarchy.

The system supports, among other things: task assignments and allocation, alert management, notifications, dashboard, reports, and more.

All the important information on each case (alert sources, related resources, and other info) is easily accessible from within the system.

Smart Alert SuppressionMechanism

Smart automation for past approvals management and constant monitoring of historical vs. current data. Reduces the overall false alert rates from the system’s average of ~3% by another ~50% over time.

Fincom’s Alert Suppression mechanism resolves the dangers of the risky practice of whitelisting.

Automated Lists Update

Fincom’s ‘Automatic Synchronization’ feature allows the system to automatically compare the Sanction list copy within the AML Suite against the latest version of required sanction lists. The system is looking for differences between the entries, including changes to the existing entries (delta) and removal or addition of entries, and updates the system’s copy accordingly.

Traceable & Transparent

Audit Trail

Supports and explains the decision-making process, providing full easily accessible information and logs on each decision.

Reports

Reports include: metrics and query log of each analyst, KPI’s, cases resolved by automation / analyst / status, data sources logs, time stamps, and more.

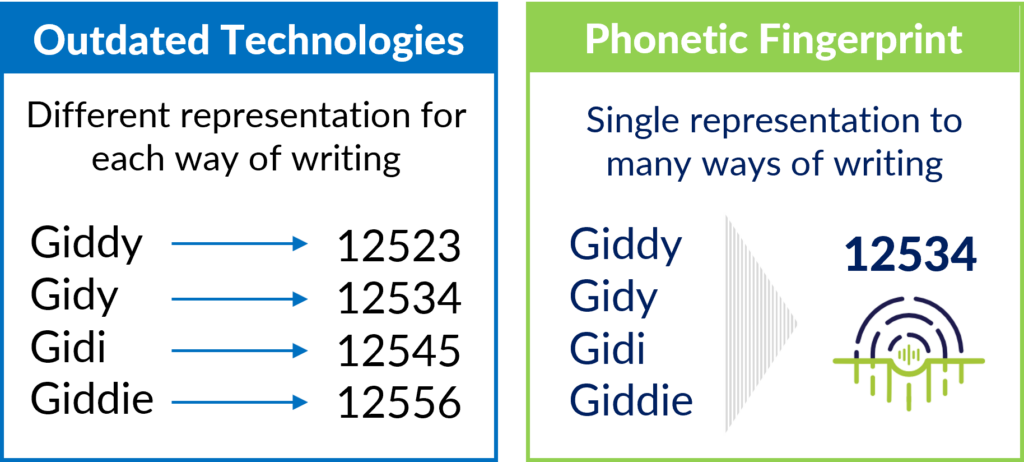

Fincom offers a robust AML screening solution that utilizes advanced technology for accurate name matching. The solution incorporates a powerful Phonetic-Linguistic engine with a phonetic fingerprint core-technology, enabling real-time verification of data across multiple sources and 44 different languages in original alphabets. It successfully resolves different name transliterations, pronunciations, and spelling mistakes and variations.

Based on the Phonetic Fingerprint Technology, Fincom’s solutions are specifically designed to provide a high level of effectiveness and precision. The mathematical decision-making mechanism is transparent, traceable, and explainable, aligning with regulatory and operational requirements.