Alert Suppression Module significantly reduces False Alerts Rate

and, as a result, reduces operational burden & costs by 90%

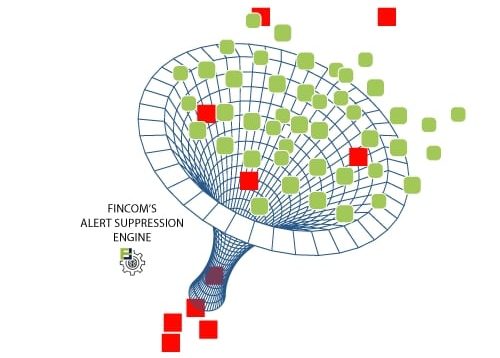

Fincom’s Smart Alert Suppression mechanism filters both False Positives and non-justified discriminating results.

Alert Suppression is based on ‘Accurate Name Matching’ capability combined with examination of additional information about an entity, such as address, birthdate, or other.

‘Smart Alert Suppression’ incorporates various methods to distinguish between Individual or Company, and to activate different algorithm methodology and control thresholds, according to risk-appetite.

The Alert Suppression demonstrates a significant ability in resolving False Positives, ensuring that names pass through only in case of an Accurate Name Match for the entire name. It means that the engine has the ability to produce sufficient phonetic proximity as justification for Alerts.

ENHANCE YOUR CURRENT AML SYSTEM WITH ADVANCED CAPABILITIES

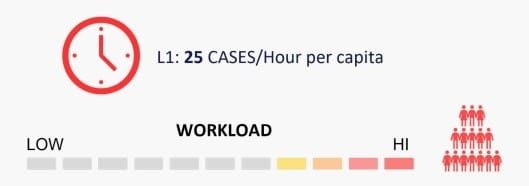

Saving up to 90% of operations related to manual resolution, which results in saving working hours, operational burden and overall costs

The exceptional ability to ensure Accurate Name Matching and filter out the vast majority of false Alerts provided by Phonetic Fingerprint technology

Logic-based end-result with managed threshold(s). Configurable processing mechanism with consistent scores & outcomes

‘Accurate name match’ with high phonetic proximity, ensures reliable, accurate and efficient screening. No missed hits, couples with significant reduction of false positives

AUTOMATIC ALERT SUPPRESSION VS. MANUAL PROCESSING

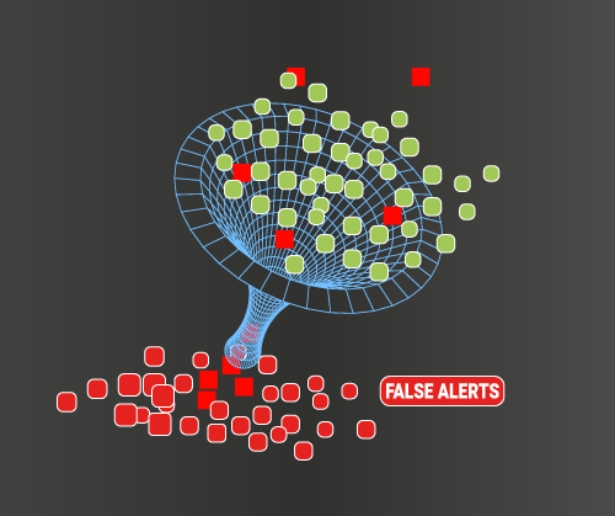

Most of currently available AML tools produce high Alert Rates and, consequently, high rates of False Positives per Alert. As a result, an enormous number of cases must be resolved manually by the compliance teams, which leads to significant operational burden and costs, not to mention noise within the operation that causes possible hits to be missed.

The cause for high level of Alerts & False Positives lies in a poor ability to match names accurately. At the same time FI’s are pressured to set fuzzy logic threshold at a higher level in order to prevent Missed Hits. This increases False Positive rates even further.

In response to this problem, compliance solutions add rule-based mechanisms, initiated by humans, aimed at reducing the number of alerts. Thus, the system can no longer fulfil the purpose it was designed for in the first place.

Attempting to solve this issue, FI’s are adding AI-based solutions that try to learn, emulate human decisions, and improve upon the rules added by people. However, this only amplifies the problem caused in the first place, by a shaky foundation, which is based on an outdated technology, the technology that was not designed for and, therefore, cannot achieve reasonable linguistic and phonetic proximity, i.e., Accurate Name Matching.

Fincom’s Alert Suppression Module helps considerably decrease the rate of Alerts & False Positives and provide accurate results with its unprecedent ACURATE NAME MATCHING capability