Banks and Financial Institutions

A New Era in AML Compliance

Numerous US banks are already benefiting from using Fincom’s AML Screening Solutions for KYC, Wire, SWIFT, ACH, RTP, and more.

In today’s interconnected financial landscape, banks and financial institutions are bound by rigorous AML regulations.

The complex cross-border and cross-jurisdiction payments landscape places banks and other financial bodies at the forefront of AML/CTF regulatory compliance, facing potential repercussions for lapses. Funding for terroristic activities can clandestinely maneuver through complex transactional layers.

Financial Institutions grapple with challenges including elevated operational costs associated with AML compliance: extensive workload in compliance departments, inflated alert rates, a lack of transparent audit trail, and more.

Recognized for its revolutionizing impact

on the future of Banking AML Compliance

"Our current vendor required lengthy updates several times weekly and a very high false positive rating. We requested a demo from the Fincom team and were incredibly impressed with its behavioral analytics, ease of use and the customer service of its team. ...Fincom did testing and implementation in an accurate and efficient way! I am very pleased with Fincom and would recommend it to any financial institution as a more effective way to scan wires for OFAC violations with very few false positives."

Connie D. Rettig, AVP & MANAGER, Wire Transfer Department,The National Bank of Indianapolis

"We decided to go with Fincom and with a very short window of time from date of introduction to end of contract with our [former] vendor, Fincom went into action! This is highly uncommon with most vendors, but Fincom did testing and implementation in an accurate and efficient way!"

Connie D. Rettig, The National Bank of Indianapolis

Relieve Operational Burden

With minimal alert rates and workload, the banks benefit from an >90% reduction of operational costs "With an alert rate as low as 5-7%, there is no need to ever replace the system." (Head of Sanctions Screening, top tier global bank)

Save Time and Resources

"...before we started using your system, I'd roll into the office and dive straight into a mountain of alerts. It was like my never-ending jam. But just a few days in with your tool, and I'm breezing through the few alerts we get in like 30 minutes. Now I actually have time for other stuff. Super cool - thanks a ton!" (Compliance Office at one of US banks that started using Fincom's system)

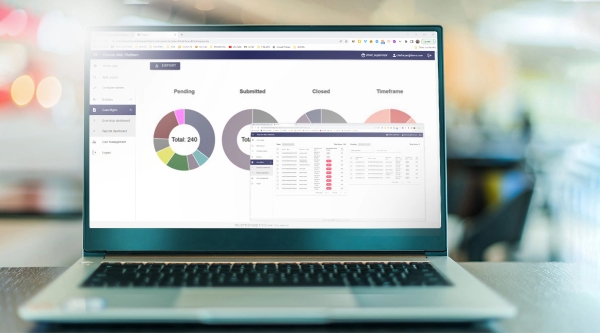

One Management System for all AML Processes

No need to deal with numerous suppliers and different platforms. Enjoy using a single intuitive UI for all AML Sanction screening tasks at all levels: from analysts to Chief Compliance officers.

Be on top of the things and readyfor an Audit

Transparent, explainable and traceable processes. Clear Audit Trail accessible at any time for internal or external audit.

Compliance made easy with AML SUITE FOR BANKS & FI's

- Accommodating specific requirements of each payment method:

- Wire

- SWIFT

- RTP

- ACH and more

- KYC/KYB Onboarding & Ongoing Screening (Perpetual KYC)

- Intuitive graphic Case Management System

- Ready for internal or external Audit

Why Fincom

Proven in US Banks to reduce operational costs by >90%

Accurate and immediate sanction screening upon onboarding

Accurate ongoing monitoring (pKYC) pursuant to regulations

Frictionless AML Sanction screening for cross-border transaction

The lowest Alert Rate on the market: <1-7%, depending on payment method

STP Rate – 95%

Explainable and transparent process, clear audit trail

All processes are managed throug a single centralized graphic UI