Real-Time Compliance (RTC) meets Real-Time Payments (RTP)

In an era where financial transactions move at the speed of light, ensuring these payments are compliant, secure, and efficient is paramount. Enter the trailblazing collaboration between Finastra and Fincom.

Finastra and Fincom established a close collaboration to deliver a unified solution: Finastra’s leading Real-Time Payment (RTP) together with Real-Time Compliance (RTC) system led by Fincom AML Sanction Screening and its Real-Time Compliance Boost-API.

This breakthrough methodology sets the foundation for each vendor to contribute their specialized expertise by connecting to the Boost-API to deliver AML compliance for RTP, forming a unified community solution that surpasses what anyone could achieve individually, and geared to grow and improve with ever changing demands. Finastra delivers a fully developed advanced RTP platform with the foresight that RTC is required, thus adopting Fincom’s superior OFAC screening solution which Finastra has already implemented in numerous US banks optimizing compliance and significantly reducing associated costs.

Fincom's Real-Time Compliance

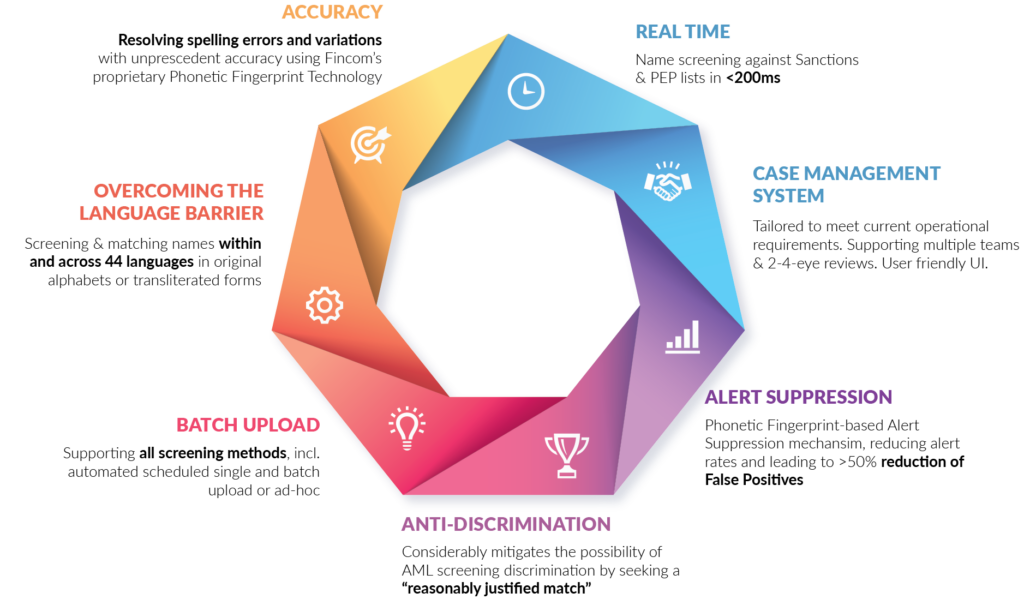

Fincom’s Real-Time AML sanction screening system allows conducting instantaneous (<200 milliseconds) secure transactions screening with unprecedent accuracy. Empowered by patented Phonetic Fingerprint technology, it excels in precise efficient screening, considerably reducing alert rates, manual resolution time, and operational expenses.

Its full Real-time AML sanction screening solution for KYC onboarding and pKYC (ongoing monitoring), real-time sanction screening for all payment rails powered by proprietary Phonetic-Linguistic engine, contributing to the reduction of alert rates from >30% to <3% and ensuring no Missed Hits.

Finastra's Real-Time Payment

Finastra provides its RTP platform, proven to be the best solution for real-time payments processing worldwide, along with deep industry penetration and established superior reputation as the leading payment platforms provider.

The synergy

By merging their distinct capabilities, Finastra and Fincom have birthed a unified solution that surpasses individual potential. This partnership isn’t just about RTP or RTC, but a holistic platform that presents a strong shield for banking operations. This community-first approach has set a foundation, paving the way for other partners to join and collectively elevate the standards of banking operations.

This is not just a technological breakthrough. It’s a philosophy of unity. By setting competition aside and focusing on collaborative growth, these companies have positioned themselves as “community pioneers”. Fincom-Finastra RTP-RTC solution, deeply integrated and open for partnerships, marks a transformative change in the banking sector.

Proof lies in Performance

Customers don’t just have to take our word for it. The efficacy of this collaboration is evident in institutions where it’s already in play. With a significant reduction in operational expenses (over 90%), a drastic cut in alert rates (from the industry average of 30-50% to less than 3%), and a shortened manual alert resolution time (from an average of 8 minutes to just 30 seconds), the advantages are clear.

For those still on the fence, a hands-on demonstration showcases the platform’s real-time payments processing and its unparalleled AML screening capabilities. Witnessing this in action provides undeniable proof of the system’s benefits.

In the end, it’s the vision, mission, product, and service that win trust. Fincom and Finastra, with their shared goals and unwavering dedication, have crafted a solution that not only meets the challenges of today but is geared for the demands of tomorrow.

For financial institutions seeking an all-encompassing, efficient, and secure RTP-RTC solution, the Fincom and Finastra collaboration presents an offer that’s hard to refuse.