The essential regulatory obligation of anti-money laundering (AML) sanction screening involves the meticulous task of comparing names, addresses, and other details in financial transactions against various watchlists, including government sanction lists. It is a tedious undertaking that regulators insist on performing multiple times every day year-round. Whether it’s processing payments, granting loans, or updating sanction lists, AML sanction screening is mandatory.

Existing technologies and operational challenges

The primary reason for excessive operational costs and the tedious structure of sanction screening lies in the outdated nature of existing technologies. These technologies, even the new ones, are not designed to meet the current regulatory and operational demands, particularly the need to screen against huge and diverse multilingual databases of individuals and entities. Consequently, matching names accurately becomes a major challenge.

Alerts, false positives, and false negatives

Currently, the market primarily focuses on three parameters: alerts, false positives, and false negatives.

Alerts indicate a probable hit. Existing technologies yield an average alert rate of 30-50%, contributing to an overwhelming number of alerts.

False positives represent the multiple results obtained per alert. For instance, when using systems considered “advanced” in today’s AML technology landscape, there are approximately nine false positives generated for every single alert. This results in a prolonged alert closure time, averaging over eight minutes. And time is money!

False negatives denote the missed hits, signifying names that should have triggered enhanced due diligence but did not. While this implies that a criminal may have evaded detection, it also indicates that a name requiring scrutiny did not receive the necessary attention.

Introducing the total cost of ownership (TCO)

It is essential to introduce a fourth parameter: the total cost of ownership (TCO). The TCO encompasses the variable costs associated with alerts, false positives, and false negatives, which need to be calculated collectively. This includes expenses related to IT licenses and operational activities required to resolve alerted cases.

It is vital to consider potential costs such as fines due to missed hits, reputational damage, customer retention issues arising from extended processing times, and frequent false alerts.

Considering TCO for choosing sanction screening technology

When a bank is selecting a sanction screening technology, the TCO should be a key consideration. It accurately reflects the true burden imposed by this regulatory requirement. Even if a company pays a higher price for the IT license, a reduced operational burden leads to a far more favorable TCO, saving over 90% in operational costs.

Enhancing AML compliance and reducing operational costs by >90%

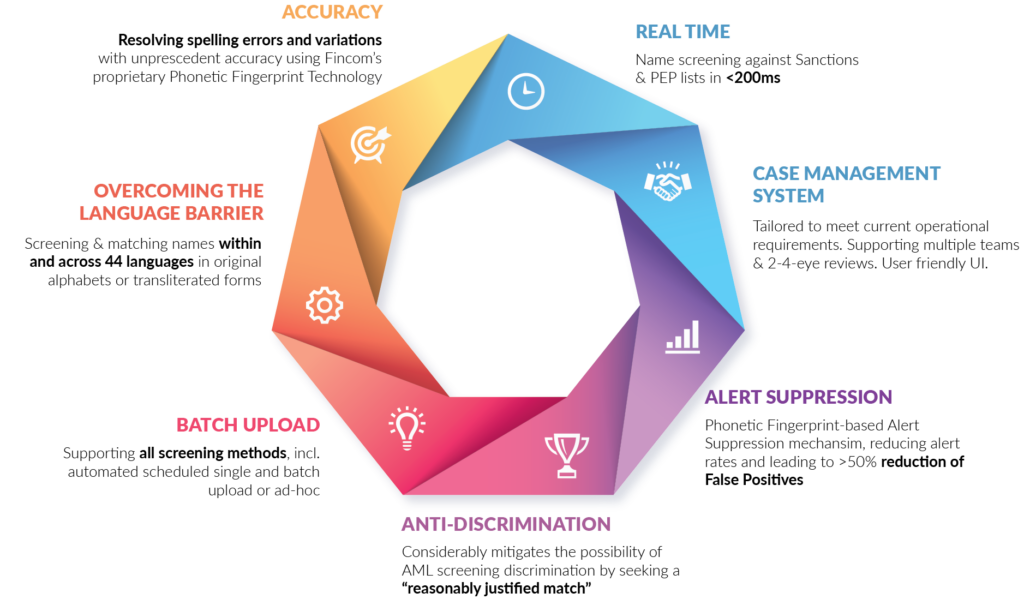

Fincom has developed and deployed a cutting-edge Real-Time AML Sanctions Screening solution that offers the most efficient and effective screening capabilities to banks and other regulated institutions.

Along with ensuring smooth real-time screening with no misses and the lowest on the market alert rate (<3% as opposed to over 30% current market average), Fincom’s solution helps reducing operational expenses by over 90%!

Interpretability and explainability

AI models, especially complex ones like deep learning neural networks, lack transparency and interpretability. It becomes challenging to understand why the AI system flagged a particular transaction as suspicious or missed a money laundering case. This lack of explainability hinders effective auditing, accountability, and regulatory compliance.

In today’s regulatory regime, the regulated institutions are required to provide a clear audit trail for all their AML screening decisions, which becomes impossible when an AI system is deployed.

Fincom’s platform provides solutions for each and every challenge of the AML Sanction Screening

90% reduction of operational costs:

Fincom’s AML Sanctions Screening has been proven to reduce alert rates to below 3%. With its highly effective alert suppression mechanism, the system reduces it even further (below 1% over time). This leads to >90% reduction of operational costs!

Accurate name matching

At the core of Fincom’s Real-Time AML Sanctions Screening lies its innovative phonetic-linguistic engine. it allows tracking phonemes across 44 languages, as well as transliterated names, considering spelling mistakes and variations. This ensures accurate name matching, free of “AI bias” and applicable to both simple and structured names.

Multi-lingual capabilities

By recognizing both the names in their language of origin and their transliterations, Fincom’s technology overcomes language barriers and matches names directly without the need in romanization”.

Real-time screening

Accurate name screening in <200 milliseconds

Perpetual KYC

Fincom saves human and technological resources and increases compliance by providing a fully automated perpetual know your customer (KYC) solution that does not disrupt the usual workflow.

Clear Audit Trail

Straightforward and transparent audit trail for internal and external audit

Case Management System

Intuitive case management system with an integrated permission hierarchy to facilitate operations across multiple teams with both two-eye and four-eye reviews

In the realm of AML and compliance technology, Fincom’s Real-Time AML Sanctions Screening stands out as a powerful solution that addresses the challenges faced by financial institutions. With its advanced phonetic-linguistic engine, multi-lingual capabilities, real-time screening, and minimised alert rates, Fincom empowers banks to strengthen their AML compliance efforts while minimising operational costs. By leveraging Fincom’s technology, financial institutions can enhance and ensure regulatory compliance in an increasingly complex financial landscape.