As the attempt of invasion of Ukraine by Russian military forces continues, the world is turning its financial back to Russia, cutting off Russian citizens, companies and associated assets from all major international banking systems. More and more names are being added to sanction- and watchlists every day. Today more than ever. Companies, social and financial institutions, sport clubs, and even colleges, universities, and concert halls are cutting ties with Russia.

But it’s easier said than done.

All these organizations, companies, and institutions face the issue of isolating the sanctioned or unwanted individuals and companies from their databases, of screening the internal data sources, cross-checking entries within various internal branches or departments and cross-referencing them with external data sources. Add to this the challenge of identifying and matching Cyrillic-based names with possible transliterations and spelling errors.

And that’s not it. We mustn’t forget about China that has its own Cross-Border Interbank Payment System (CIPS) and (at least for now) is considered to be Russia’s most “promising” ally. The CIPS can settle international claims in Chinese currency (yuan). As mentioned by Asiatimes, China’s CIPS “can replace SWIFT for Russian trade financing.” This in itself creates several issues and poses some questions.

Let us just take a look at this one:

How can Financial Institutions, mostly banks, ensure that no sanctioned physical persons or corporations are involved in a transaction that is not only carried out through a third party, but most probably involves a whole chain of different parties from several countries?

And as if this is not enough, here is the real-life instance when entities originally defined in three totally different language systems (Cyrillic, Latin and Chinese) are, with a high probability, being involved in a great number of potentially problematic transactions.

Most name screening and entity matching technologies are deigned to search in sanction and watchlists using Latin-based (usually English) characters only. But wait a minute! In the best-case scenario, the names of the individuals and/or companies involved in the said transactions, will be transliterated, which in itself results in numerous discrepancies in name spelling variations. In the worst-case scenario, all the parties’ names will remain in their original languages… Russian, Chinese and (probably) English.

What can the US do in this case? Either the transactions under discussion slip through the screening systems and, thus, the Western world did nothing but let Russia and China enjoy their little “win” or it can close the business gates for Chinese transactions and let everyone “lose.” As a Chinese academic said: “The RMB cross-border payment system still relies on banks as nodes, and these nodes can be sanctioned and pressured.” Well… no “node” would want find itself in this position.

Is there no solution?

There is.

Fincom’s AML multilingual engine that can not only effectively and accurately match entities (names) in over 40 languages, including Russian (and other Cyrillic languages), Chinese, and, of course, Latin languages (English), but also “see through” the spelling mistakes of transliterated names.

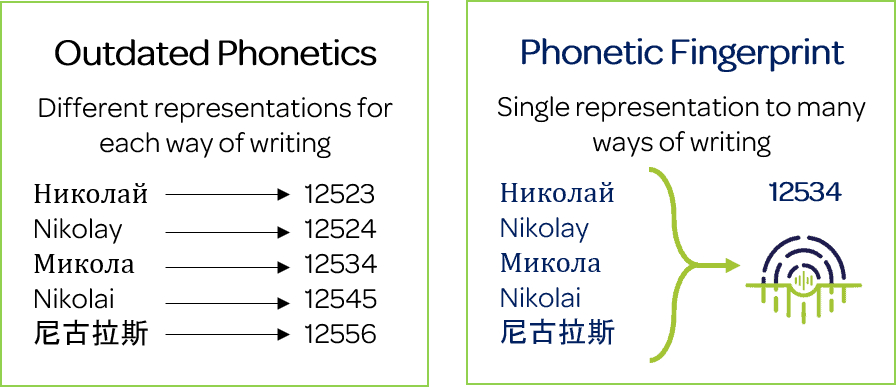

Based on its unique patented phonetic fingerprint technology, the engine “translates” any name by its sound into a mathematical code, overpassing language-specific characters, transliterations, possible errors and name spelling variations.

It’s a simple back-end micro-service add-on that can work with almost any of the current screening systems used by banks and other FI’s. It does not case any change in the compliance (AML or other) workflow or user-experience.

Works in real time, taking less than 200ms for transaction screening. Provides over 30% of false positives reduction and protects against false negatives (missed alerts).

Let’s look at a simple example, just to see how it works:

Example:

- Николай Евменов (Russian origin)

- Nikolay Yevmenov (English transliteration 1)

- Nekolai Evmenov (English transliteration 2, more variations are possible)

- Микола Євменов (Ukranian transliteration)

- 尼古拉·葉夫梅諾夫 (Chinese transliteration)

Fincom’s name matching simple add-on based on its patented phonetic fingerprint technology is, today, probably the only viable solution that could allow effectively sanctioning criminal bodies while keeping banks in business and saving them from charges and fines.