Ensuring consistent outcomes, increasing efficiency, achieving significant reduction in operational costs and risk of errors; The automation engines also create the ability to dynamically meet changing requirements and levels of ‘Surge capacity’.

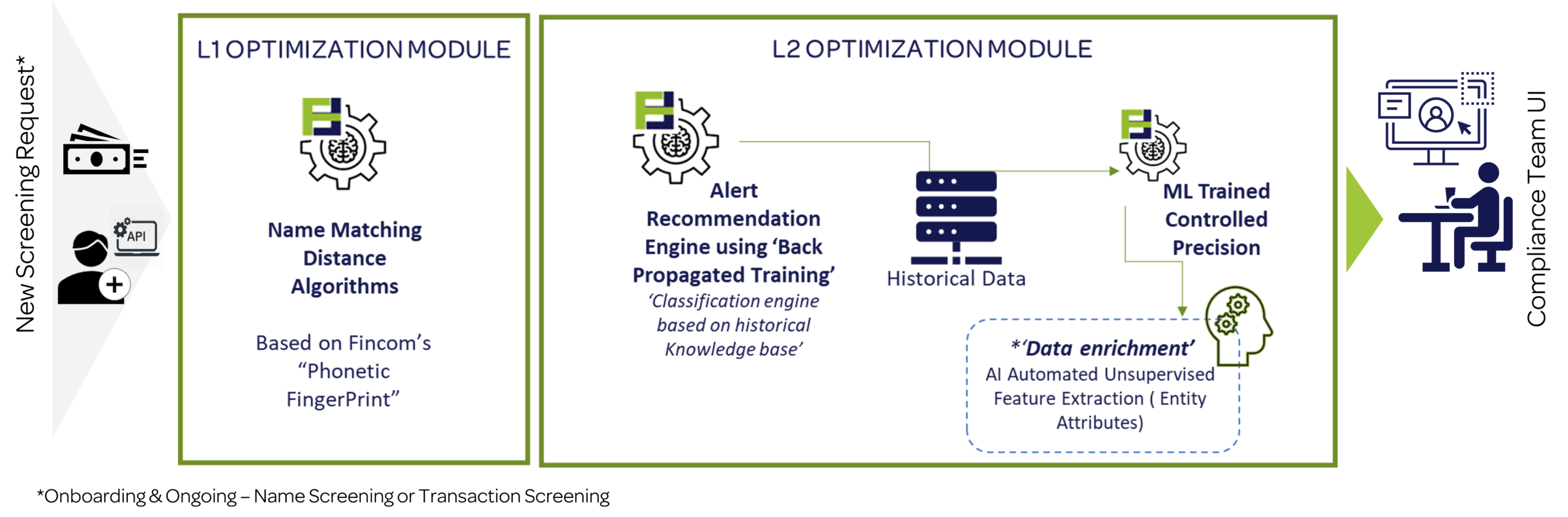

FinC.AML Level-1 & Level 2 Filtering Automation is an Advanced ML/AI Engines – easily integrated into the existing computerized systems as well as a natural part within the work-flow process of your Compliance Team.

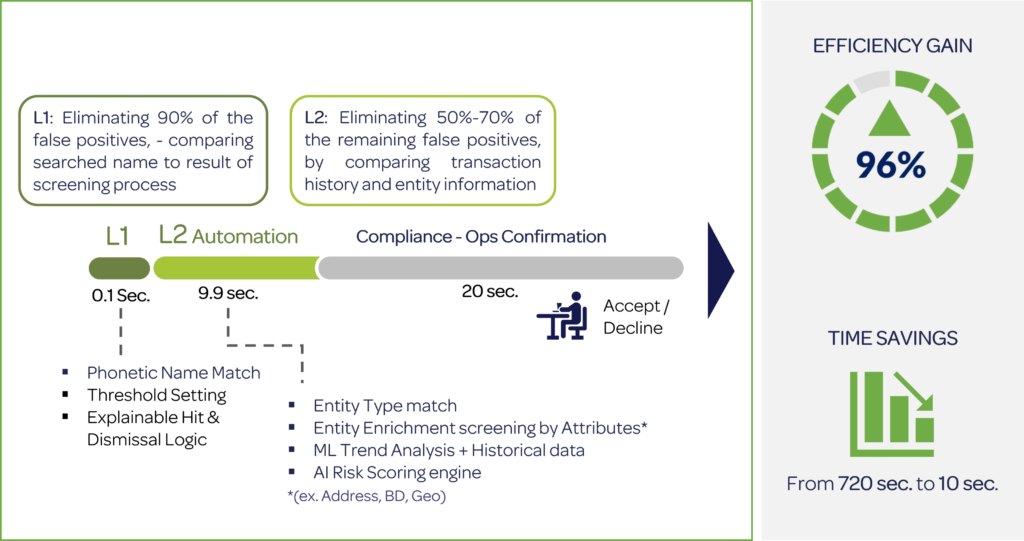

In the process of Name Screening, it is not uncommon that 90% out of the list of “potential name match” suggested by the various AML systems, does not represent a real match between the “Searched Entity Name” and the “Names on Alert”.

In standard Manual Level 1-2 Screening processes, a human eye will immediately detect that those 90% cases are not a real match to the Searched name.

So , whilst human logic can easily filter out most irrelevant cases, this is exactly the main cause of unnecessary workload. So, as an example: If a search will end up with over 100 results, it can take more than 2 hours for a compliance personnel to resolve all False Positive Alerts.

Moreover, in the case of Transaction Screening, this method of manual resolution, is a major obstacle to Realtime Service.

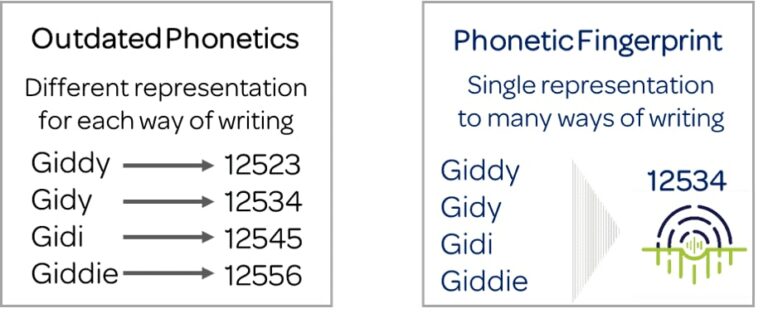

Phonetic fingerprint is a mathematical representation of the pronunciation and phoneme of a name (individual person or other entity).

Using automated Real-time technology, supported by AI-ML layers, using over 48 mathematical algorithms, tracing phoneme & accurate name-matching across 38 different languages, transliterations and spelling variations.

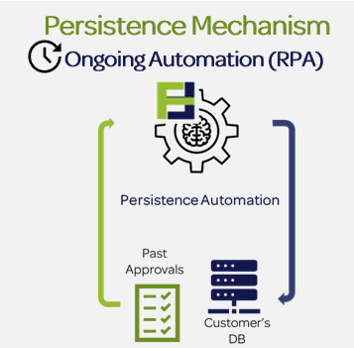

An automated process, designed for ongoing verification resolving 60% of Potential Alerts, Automatically!

On each time there is a change in Sanction and PEP lists – changes will be verified automatically, and only real-alerts will be forwarded for further resolution; so unless there is a change of data the Compliance team will not be Alerted for no reason, whilst if there is a change it will not be missed.

FINCOM’s “Phonetic fingerprint” core technology; a mathematical representation of the pronunciation and phoneme of a name (individual person or other entity). Tracing phoneme & exact name-matching across 38 different languages, transliterations and spelling variations.

AI decisions engine processing the L1 phonetic match and L2 components (Entity type, date of birth, Geo, ML past decisions), scoring results providing detailed findings and a recommendation to clearing alerts or towards further investigation by compliance team.

Second process of filtering False Positives, based on AI analysis of Past Historical Data of both the ML decisions as well as the compliance team decisions. In this way it can ensure no miss-hits whilst optimizing the filtering and clearing of False Positives.

AML Onboarding Sanction & PEP Screening – ‘Accurate Name Matching’ with minimal False Positive rate

Automating Ongoing Monitoring (RPA) – Re-check daily the entire customer database & past decisions

Realtime Transaction Screening – Real-time check of ALL Entities involved in a transaction: Payer-Beneficiary-FIs